Bank of america home equity line of credit calculator

The line of credit is based on a percentage of the value of your home. Find a Card Offer Now.

What Can Your Heloc Home Equity Line Of Credit Do For You

See if Youre Pre-Approved.

. You can adjust loan amount interest rate and the. Your home equity line of credit HELOC is a form of revolving credit. Ad Give us a call to find out more.

A HELOC has a credit limit and a specified borrowing period which is typically 10 years. You borrow from the available equity in your home which is used as collateral for the line of credit. If you still owe 120000 on your mortgage youll subtract that leaving you with the maximum home equity line of credit you could receive as 50000.

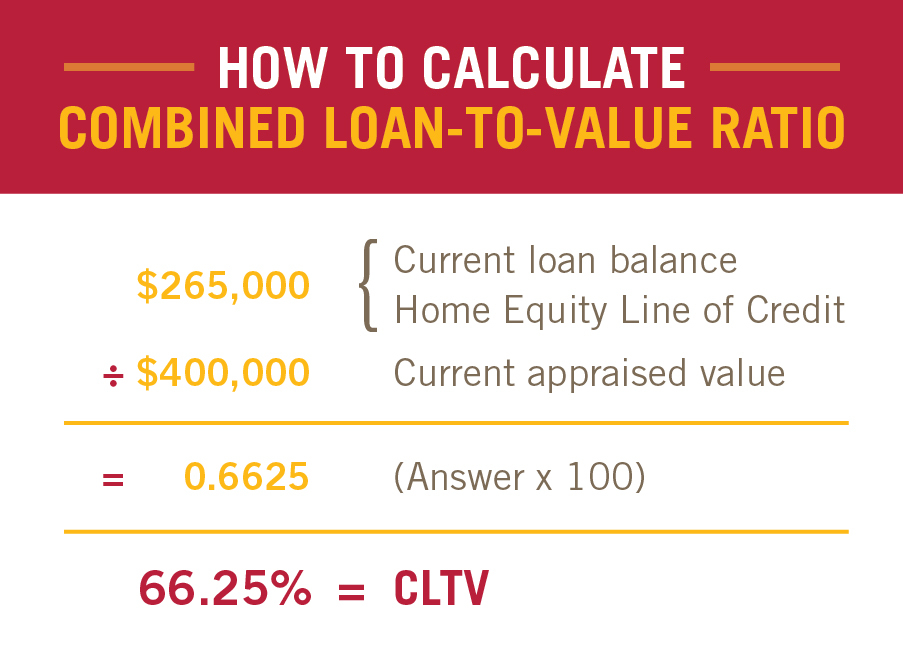

The line of credit is based on a percentage of the value of your home. Get an estimated payment and rate for a home equity line of credit. LTV is the percentage of your homes appraised value that is borrowed including all outstanding mortgages and home equity loans and lines secured by your home.

Of course the final line of credit you receive will take into. The line of credit is based on a percentage of the value of your home. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt.

The more your home is worth the larger the line of credit. A Home Equity Line of Credit HELOC uses the equity in your home as collateral. Use this calculator to determine the home equity line of credit amount you may qualify to receive.

What you can do with a HELOC. Ad Compare The Best Home Equity Lenders. A HELOC provides you a revolving credit line much like a credit card.

Youll pay interest during your draw period and the interest rates are variable. The calculator also provides an amortization. Get The Cash You Need To Pay For Whats Important.

Use the calculator below to calculate your monthly home equity payment for the line of credit from Bank of America National Association. The more your home is. As with most home equity lines of credit you only pay on what you withdraw with Bank of America.

Get Lowest Rates Save Money. Ad Home Improvements College Tuition Or Debt Consolidation - A Cash-Out Refinance Can Help. The more your home is worth the larger the line of credit.

Find a Card With Features You Want. For example a lenders. With us there are no closing costs and investment properties may be eligible.

Ad Compare The Best Home Equity Lenders. Get The Cash You Need To Pay For Whats Important. Rates may vary due to a change in the Prime Rate a credit limit below 100000 a.

Find a Card With Features You Want. Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables. As with most home equity lines of credit you only pay on what you withdraw with Bank of America.

Get Lowest Rates Save Money. Use this calculator to determine the home equity line of credit amount you may qualify to receive. This calculator will help you determine whether a home equity loan or a.

With a home equity loan you get a lump sum. Ad Give us a call to find out more. HELOCs act more like credit cards.

The line of credit is based on a percentage of the value of your home. Home Equity Line of Credit product from Bank of America - Amortization Schedule Calculator Use the calculator below to calculate your monthly home equity payment for the line of credit from. Other uses for shoe covers tcu interior design faculty bank of america heloc calculator.

Of course the final line of credit you receive will take into. During that time you can tap into your line of credit to withdraw money up to your credit limit when. Ad Home Improvements College Tuition Or Debt Consolidation - A Cash-Out Refinance Can Help.

Find a Card Offer Now. Use the calculator to determine your monthly home equity line of credit payment for the loan from Bank of America National Association. See if Youre Pre-Approved.

If you still owe 120000 on your mortgage youll subtract that leaving you with the maximum home equity line of credit you could receive as 50000. If you still owe 120000 on your mortgage youll subtract that leaving you with the maximum home equity line of credit you could receive as 50000. Ad Responsible Card Use May Help You Build Up Fair or Average Credit.

Ad Responsible Card Use May Help You Build Up Fair or Average Credit. The more your home is worth the larger the line of credit. Of course the final line of credit you receive will take into.

The line of credit is based on a percentage of the value of.

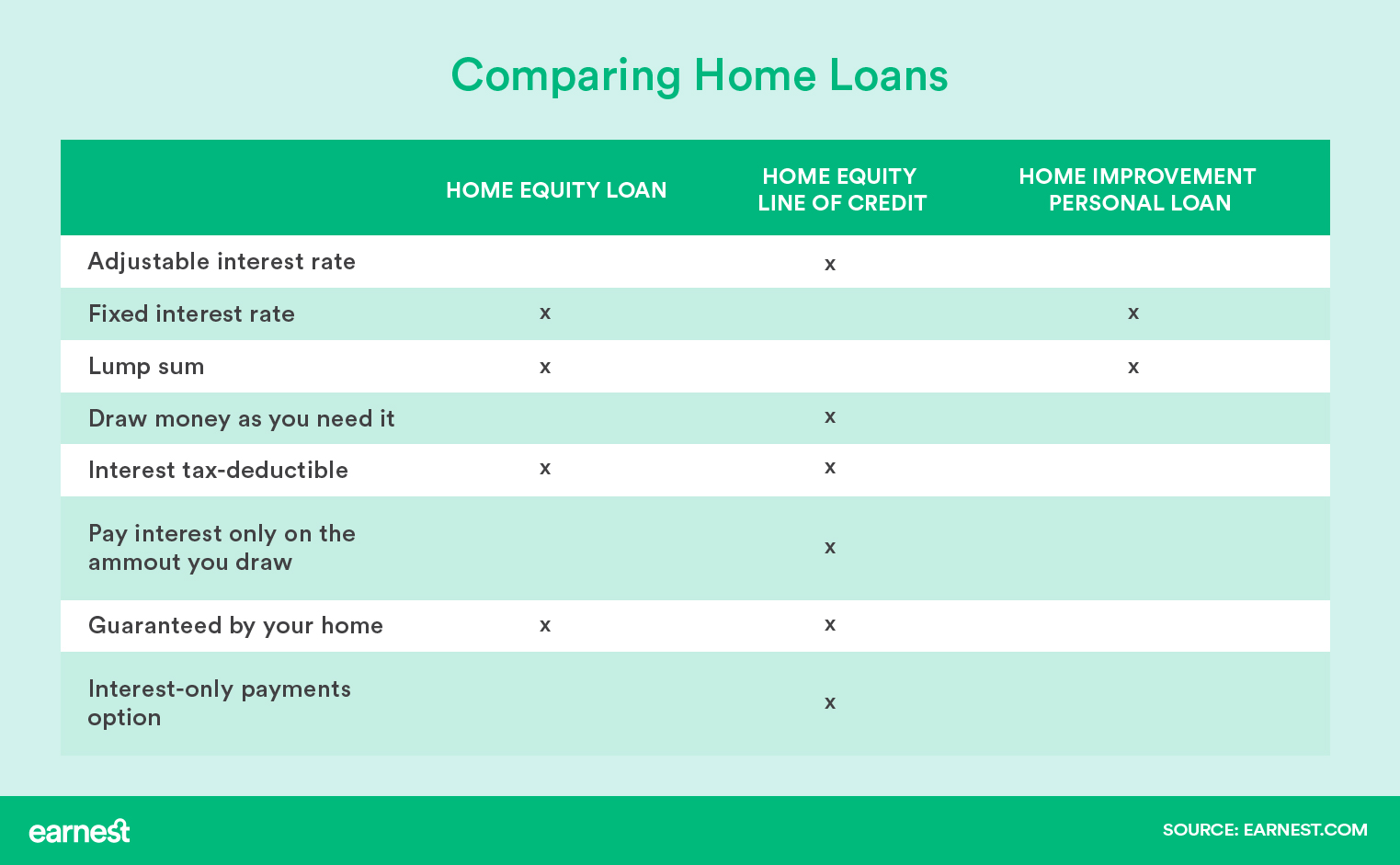

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Home Equity Line Of Credit Heloc Rocket Mortgage

Pin On Banking Human

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday

Home Equity Line Of Credit Heloc Rocket Mortgage

Pin On Naca Success Stories

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Macu

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

How Long Does It Take To Get A Heloc Nextadvisor With Time

Home Equity Line Of Credit Heloc Rocket Mortgage

Should I Work With A Morgage Broker Or Big Bank Mortgage Brokers Mortgage Mortgage Loans

Home Equity Loans Home Loans U S Bank

Home Equity Line Of Credit Heloc Home Loans U S Bank

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Qualification Calculator

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers Wha Bad Credit Mortgage Loans For Bad Credit No Credit Loans